So you are new to investing, you want to explore investment opportunities so you thought real estate investing is worth exploring. Maybe you are a seasoned investor and you are struggling to draw up the best way to have exposure to real estate. Personally, I have invested in both and I will go over the pros and cons of each and explain why I prefer REITs over physical rental properties.

First, let me tell my story

When I bought my first rental property, it was in a popular student area next to Brock University. My intention wasn’t to buy it as a rental property and since I was in a city I was unfamiliar with, I had no idea it was in a popular student area until after I bought the house. I wanted to become a homeowner first and had no intentions to rent it out.

So when I discovered this 1200 sq ft bungalow with a detached garage(that was bigger than the house itself) to store inventory for my online business, it was perfect for me and I jumped on it! Then there was the possibility of offsetting the mortgage by renting out a couple rooms or the basement. There was a lot of potential.

So I posted an ad for the first time on the university off-campus website to see what would happen. I didn’t expect much but to my surprise, I was getting a call every hour! The phone didn’t stop ringing and I was getting swamped with phone calls even after I took the ad down.

So I rented out 3 bedrooms and I lived in the basement. So I was bringing in $1,350($450 per room inc utilities). For some reason, including utilities was standard in the area but the rental income was enough to eliminate my mortgage.

Of course, I wasn’t making money off the rental income but I was offsetting my cost. I only thought about turning it into a business when I realized how much demand there was. Some properties in the area converted the entire house into a student rental property with 5-7 rooms.

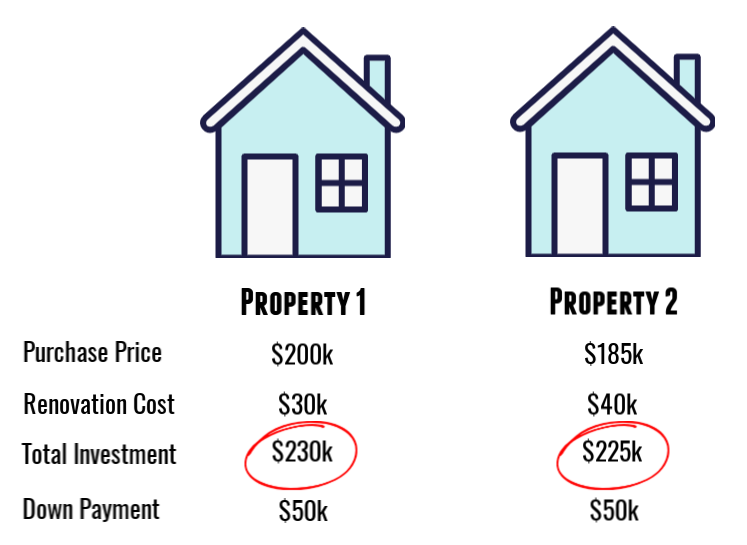

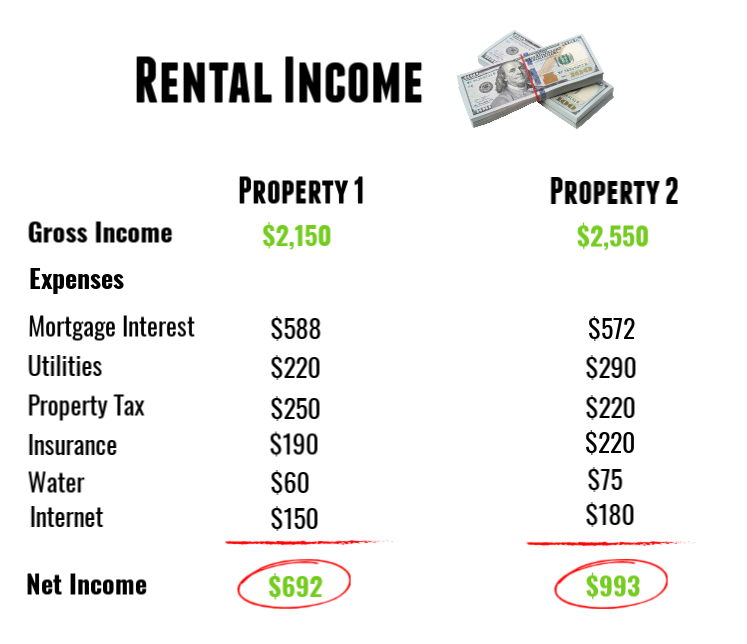

I knew I could add 2 more bedrooms in the basement that already had a kitchen w/ bathroom and I could bring in an extra $800-$900 a month. But I wasn’t ready to leave this house so I bought 2 other properties, renovated them, and converted them into complete rental properties. Lets crunch some numbers.

So as you can see, the numbers look pretty good. It also felt good owning real physical assets that were generating income and appreciating in value 2-5% a year. This is what entices a lot of new investors to own rental properties. The biggest mistake people make(including me) is ignoring other factors involved with running a rental property.

So as you can see, the numbers look pretty good. It also felt good owning real physical assets that were generating income and appreciating in value 2-5% a year. This is what entices a lot of new investors to own rental properties. The biggest mistake people make(including me) is ignoring other factors involved with running a rental property.

Here is a list what people overlook when buying a rental property:

Ongoing maintenance.

Things happen. Appliances break down, the furnace doesn’t work, the door handle is broken, plumbing issues – it’s a long list. It never ends and you need to budget for these events. $200-$300/ month is a conservative estimate.

You are on call 24/7

Your most valuable asset is your time and you give up a lot of it when you are on call every hour of the day. Managing a property is REAL work and not passive income.

Be ready for major repairs

Eventually, things need to be replaced but it could still be unexpected and unpredictable. In one year I had to replace a roof, furnace/ac and windows. This cost about $13,000 so its important to have reserves set aside.

Oftentimes rental properties get neglected. Countless properties in the neighborhood were in major need of repairs but the landlords of these rental properties don’t do anything about it. Why? Because they simply don’t have the money!

At this point, you are pretty much pushed into a corner and you have no choice but to sell it(at a loss) or find low-quality tenants that are willing to rent out your property at a reduced rate. From here its a downward spiral and there is no good scenario.

Liability

Don’t forget about the liability risk of owning a rental property. Sometimes you get problem tenants that destroy your property. You may get a tenant that smokes inside, has a pet(or maybe a few), doesn’t clean up after themselves and causes an infestation of rodents/bugs etc. Damage like this is VERY costly to repair and should be factored into the risk. Also, if a tenant gets injured, you can get sued. Not a likely occurrence but the possibility should be enough to keep you up at night. Do you know if there are any illegal activities taking place on the property? Most likely you won’t but you are held liable for this too.

Leverage

If you buy a rental property and you have a mortgage, don’t forget that you are using a lot of leverage when you acquire this investment. Banks require a 20% down payment when purchasing a rental property due to the risk. Yes, 5 times your investment! Your online broker would never let you borrow this much to invest in stocks but people tend to ignore this risk when buying a rental property.

Transaction Costs

As soon as buy the property, you are out 10% in transaction costs. Land transfer tax, legal fees, broker commissions. I’m including the costs associated with selling the property here too. Its not cheap and if you buy a rental property, you need to commit to it and hold it for a long time to make the investment worth it.

Why I prefer REITs instead of rental properties

When it comes to Reits, there are many advantages. The problems I highlighted owning a rental property should make it obvious why I favor Reits. When you can invest in the best property managers in the world just by buying shares with a click of the mouse, what makes you think you can do a better job getting into the same business? Instead of being forced to hold on to your rental property for x amount of years, you can sell your Reit shares just as quick as you bought them. Oh, and did I mention you can sell them back to the market for $0.01 a share??

Transaction Costs

Although Reits or stocks in general are more volatile than real estate, this does not automatically mean they are riskier. Yes, stock prices fluctuate and can make drastic moves based on certain events that unfold. As these events unfold, the market decides what these shares are worth so pricing these instruments are more efficient. Real estate does not have these price swings because an investor simply can’t sell the property right away by clicking a sell button. Due to the high transaction costs, you are forced to hold on to it even if the market works against you. With the leverage you are taking on, it doesn’t take much to get into trouble and have the bank force you to sell the house. Getting caught in a real estate correction or spike in interest rates is enough to wipe you out.

So are there any downsides to owning REITs vs physical rental property?

You give up control

When you invest in Reits, you are putting your trust in management and relying on them to manage the companies assets in the most effective manner. The biggest firms attract top talent that has plenty of experience in the business so most people would feel more comfortable letting them do all the work for you. I’ve learned that freeing up my time and collecting dividends is much more beneficial in the long run.

But maybe you are in a niche market or you have special expertise. Maybe you are more familiar with the area and know how to serve the community better than any real estate conglomerate. Like renting out cottages in a tourist area that you live in. In this case, you have a better chance of running a more profitable real estate business than someone operating a residential apartment in a downtown metropolitan area.

Less tax friendly

This can get more complex and the tax advantages/disadvantages should be taken on a case by case basis. With owning your own rental property, you can deduct more expenses including non-cash expenses to reduce your net income. In some cases, you can reduce your income to near zero and pay next to nothing in taxes for a long time. When you receive dividends, you pay dividend tax which is still more favorable than regular income tax. Of course, you can keep your investments in a tax-free account and pay nothing anyway so it all depends on your own circumstance or investment objectives.

Conclusion

The Reits vs rental property discussion is an ongoing debate. Hopefully, I highlighted the major pitfalls to avoid or at least consider when you are making an investment decision. Personally, I will never go back to being a landlord. If I were to give up all my valuable time to run a business, it would be for something much more lucrative than the real estate business. I’m happier investing in Reits and collecting my dividends… while I sleep!

Recent Comments